The CHAMP Plan

Health Management Plan

As a business owner, what if you could afford to give your employees incentives like free health insurance benefits and then save money from doing so?

What if it didn’t cost you anything and actually saved $500 per employee per year!?

Introducing The CHAMP Plan:

Introducing The CHAMP Plan:

Through proprietary technology and AI-based automation software you can now and are able to offer voluntary insurance benefits that greatly benefit the employer and employee.

Here’s how it works in three steps:

1. DOWNLOAD THE FREE CHAMP APP WHICH INCLUDES:

- 100% Preventative Care $0 Copay (MEC)

- Minimum Essential Coverage pays 100% of services required by the Patient Protection and

Affordable Care Act through First Health Providers. (Employee Only)

- Minimum Essential Coverage pays 100% of services required by the Patient Protection and

- $0 Unlimited Primary Care Doctor / Urgent Care Visits

- The Plan pays for office visit charges in the First Health Providers (or network of choice when available) with a $0 copay. (Employee Only)

- https://providerlocator.firsthealth.com/LocateProvider/LocateProviderSearch

- $0 Copay Prescriptions

- No copays or cost for all formulary drugs. (Employee plus Family)

- Unlimited Telemedicine and Mental Health $0 Copay

- No copay or cost 24/7/365. (Employee plus Family)

- Personal Health Manager (Employee Only)

- Proactive Medical Care to help identify potential health risks.

- Access to private consultations with personal health assistants.

- Attending Company Physician and Direct Primary Care (Employee plus Family)

- Unlimited access to a Concierge’s advocate approach to health care.

- It’s like having a doctor in your family you can contact for any reason at anytime

- Health Wallet (Employee plus Family)

- Keeps track of all your other insurance cards in one place including provider, Dr. and network look up.

- Access to the best provider prices and network

- Workers Compensation Management Cost Containment Program (Employee plus Family)

- Management and mitigation of work-related injuries to protect the employer from further liability and lawsuits.

Early management of injuries creates cost savings lowering the final cost of the injury or work-related illness.

- Management and mitigation of work-related injuries to protect the employer from further liability and lawsuits.

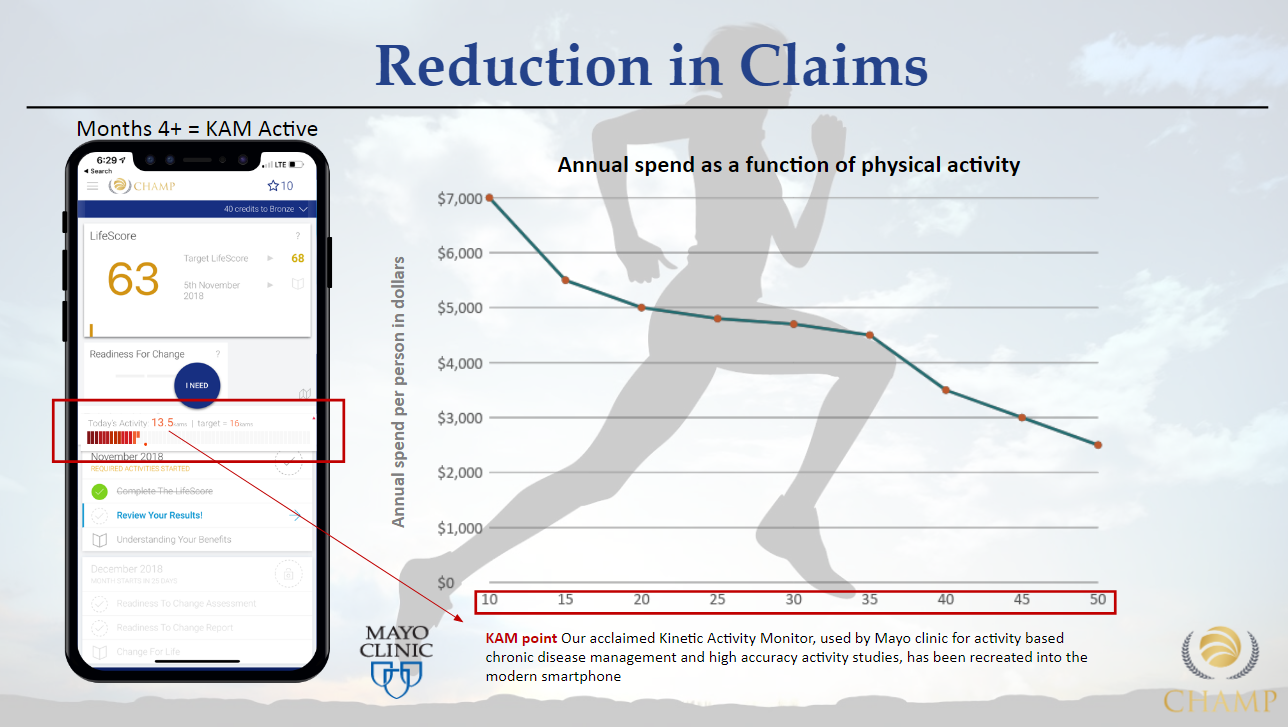

2. REDUCED CLAIMS SPENDING

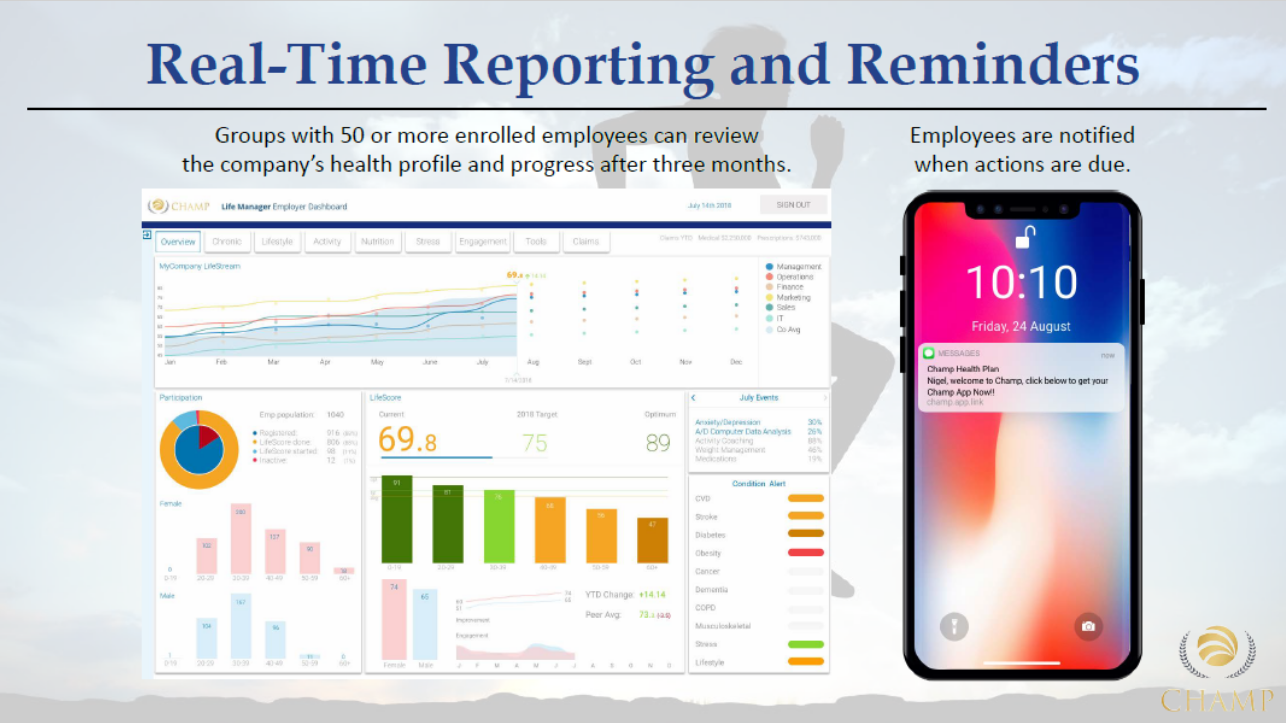

These benefits not only reduce the amount of claims that hit the existing major medical plans but by off loading these claims it greatly helps to reduce the group major medical renewal each year. Secondly, within the app (think like a pedometer on steroids) it monitors their health on many unique levels. Each month each employee gets a personalized health score- similar to a credit score. Overtime the goal is to increase their score which has a direct result on claims. The higher the health score the lower the claims will be.

To cap it off the employer is able to break down by department, age, and gender the overall health scores and how the organization is improving overtime

3. SECTION 125 SAVINGS

These insurance benefits are tax deductible which means the employer and employee saves money under section 125.

By the employees participating and using the app it triggers a (non taxable) insurance claim payment.

When combined with the Sec 125 tax savings creates a positive NET-NET gain for both the employee’s paychecks and the matching FICA, state, federal and Medicare matching taxes the employer will save a NET-NET savings of $500 per year for every employee that enrolls.